by Paul Slaybaugh | Sep 23, 2010 | Promotions, Scottsdale Real Estate

Times were a buyer could reasonably anticipate that a seller would provide a one year home warranty policy with the sale of a home. Given the equity crunch that many are experiencing, and the prevalence of short sales and bank owned homes in the current market (which typically do not provide such policies), home warranties have gone the way of the buffalo as a throw-in to a Scottsdale home sale. With the lack of disclosures and repairs that accompany distressed property sales, however, such protection has never been more important. With that in mind, we are offering the following October promotions in addition to our always competitive rates.

For Buyers:

Free Home Warranty Policy – Register to utilize Paul Slaybaugh’s services as your buyer’s agent prior to 10/31/10 and receive a complimentary one year home warranty policy with your purchase at the close of escrow. See below for additional terms and limitations.

______________________________

For Sellers:

Free Home Warranty Policy For Your Buyer – Want to stand out from the competition by offering a home warranty policy to potential buyers? I understand the equity pinch may not make such overtures possible. Let me do it on your behalf. Register to list your home for sale with Paul Slaybaugh prior to 10/31/10, and I will provide your buyer with a complimentary one year home warranty policy at the close of escrow. See below for additional terms and limitations.

…………………………………………………………………………………………………………………………..

Additional Terms: Promotion valid with website registrations prior to October 31, 2010 only. Close of escrow must occur prior to 10/1/11 for offer to remain valid. Promotion is offered exclusively and may not be combined with any other offer. Maximum value of $325 per policy. Not responsible for cost of additional coverage over and above $325. Not redeemable for cash value. Utilize registration form below to qualify.

Error: Contact form not found.

by Paul Slaybaugh | May 6, 2010 | Home Buying, Scottsdale Real Estate

So you were a good little boy scout and extracted a home warranty policy out of the seller during the negotiations for your recent home purchase. Or perhaps, unable to coax the relatively small potato item out of the seller, you opted to take your agent’s advice and spend the $400-1000 to purchase one yourself. After all, it’s pretty cheap insurance against Murphy’s Law (which holds that no fewer than four items which were inspected and functional as of a two weeks ago will simultaneously explode upon closing). While I always advise my clients to seek the protections of a home warranty, at least for the first year in which they are getting accustomed to the workings of a new home, it would be irresponsible to overlook the shortcomings of such policies. Like any other form of insurance, they are not bullet-proof, all-encompassing panacea’s for the maintenance headaches that will dot a homeowner’s horizon.

All resale homes come with pre-existing conditions. Whether the shower valve leaks when engaged, or a faulty electrical breaker causes a circuit to trip (without fail during the penultimate moment of your favorite television show), I have yet to encounter the home that does not have its own idiosyncratic, malfunctioning cross to bear. A diligent home inspection should uncover the lion’s share of the problems, but some can and do slip through the cracks on occasion. “No problem,” the common line of thought goes, “I’ll just call my home warranty provider” to correct whatever problem rears its head. The premise itself is not faulty, as home warranties are attractive for their very nature of warding off the unknown, but the assumption that whatever breaks will be covered is patently false.

Like your health insurer, the home warranty company is making the calculated gamble that the cost of your policy will outweigh the cost of the claims/repairs racked up during the coverage period. Safeguards are put in place to minimize the provider’s exposure. For starter’s, whichever company you opt to employ will include verbiage somewhere in their policy that disavows any responsibility for deficiencies in the home which pre-existed the coverage period. In other words, DO NOT assume that you can simply call the home warranty company to make repairs to items on the home inspection report that the seller refused to address during the escrow period. While no representative from the home warranty company will inspect the home prior to closing to determine what is, and what is not an existing condition, you will have a very difficult time getting them to come out to make repairs the day after you close. They will fight that claim tooth and nail as a pre-existing item.

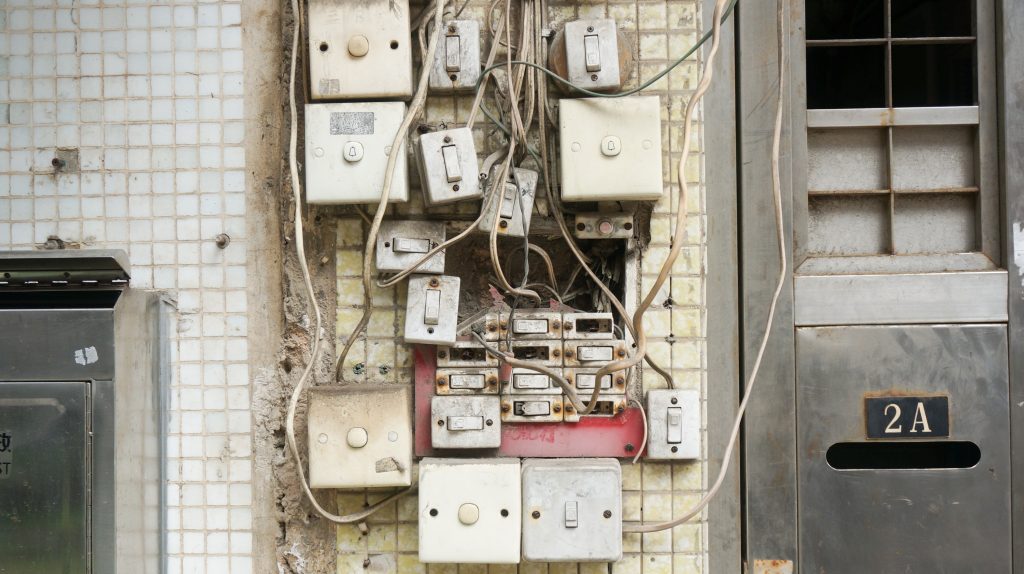

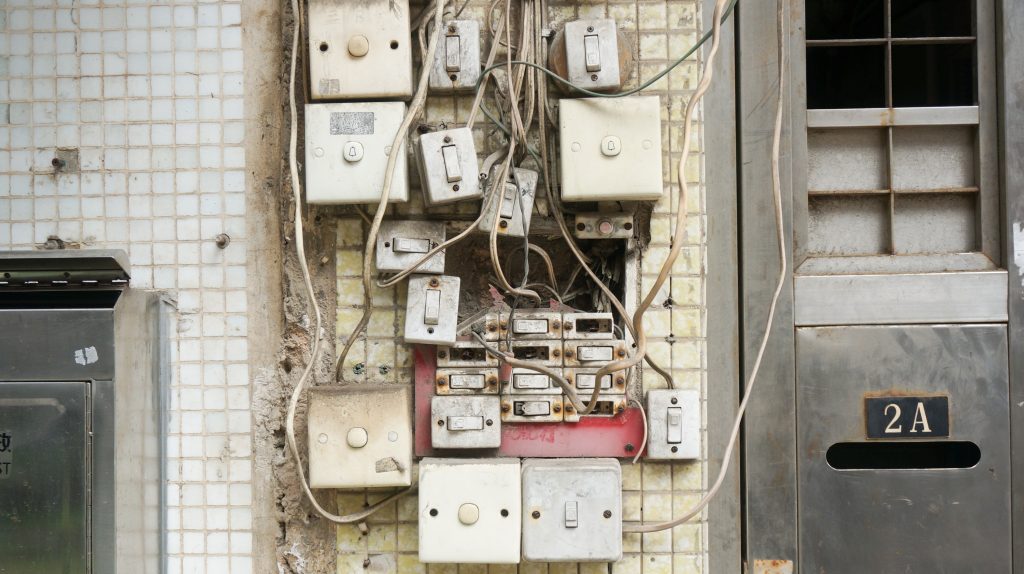

The next difficulty you may encounter with your warrantor is the “amateur installation” clause. This is another area in which you are reliant on the diligence of your home inspector. Should the seller (or any previous owner/contractor for that matter) have jury-rigged any wiring, improperly installed new A/C components or soldered a plumbing joint with all the refined skill of a narcoleptic baboon, the warranty company will deny the claim for any repairs related to such items. If your inspector discerns that the home has played host to amateur contracting hour over the years, either demand professional repairs be made by a licensed contractor prior to the close of escrow, or expect to finance those repairs out of your own pocket. You warranty provider most assuredly will not.

Lastly, the biggest difficulty that most new homeowners run into with their home warranty lies within the fine print of the specific coverages provided. Oddly enough, most people never think to actually read the policy until after the transaction has closed and something in the house blows up. Treated as an afterthought in which the buyer’s agent often suggests a reputable company while sitting around the closing table, the soon-to-be homeowner is never fully briefed on what gets fixed and what is beyond the scope of the policy. Depending on the options (offered at additional expense to the basic package) selected, many items that are assumed to be included actually are not. The major working components of the home are covered in all standard policies, but there is minutia with which to concern yourself. For example, while interior plumbing pipes are covered, showerheads and faucets may not be. Exterior water lines (sprinkler systems) and shut-off valves are often excluded from basic policies. The heating element in your built-in microwave should be claim fodder, but maybe not the lighting element. The garage door operator is typically included, but not the door or the mounting track.

Your home warranty will not cover a roof leak unless you have a Cadillac policy.

Other things to note with your policy:

- There will be a service charge every time the warranty company sends out a contractor, typically in the $50-60 range. If the item that needs repair is determined to fall within the scope of your policy, the warrantor will pay for all repair costs above and beyond that service fee.

- You may have to wrestle with the provider on major repair items. If your A/C goes out, you may have to deal with several band-aid type fixes before your warranty provider accepts the eventuality that the compressor needs to be replaced. Not a lot of fun when it is July and a hundred and ridiculous out, but an unavoidable part of the process in some instances.

- Call your REALTOR if the service department stonewalls a legitimate repair claim! We do not wield magic wands (not during business hours, at least), but we do have access to the proper ears to bend in such instances. While the service department is looking for a reason to offset expense and deny claims, we can go straight to the marketing department that solicits our referral business. The same rep who sends us promotional materials, attends our office meetings and leaves the occasional chocolate chip pecan cookie in our inboxes has a far greater incentive to keep us happy than the service department does for a single unhappy customer. I have gotten more than a few denials reversed by shaking this branch of the company tree.

A home warranty is a great and necessary thing, just be aware of its limitations. It is not wholesale insurance against any eventuality with the physical condition of your home. Read the actual coverages of prospective warranty companies before you purchase one. Employ a reputable home inspector to uncover all pre-existing or amateurish conditions to the extent that is professionally possible. Do not accept the sellers inevitable argument against your repair demands that the home warranty policy he/she is buying you will correct all items. Prepare to do battle with your chosen warrantor on high-cost items by familiarizing yourself with the scope of the coverage, enlisting the assistance of your REALTOR and sheer persistence.

As with anything, the protection of a home warranty is only as valuable as your understanding of it.

___________________________________________________

Follow the links below for coverages and options from three large home warranty providers in Scottsdale and the greater Phoenix area.

Old Republic Home Warranty

First American Homebuyers Protection

American Home Shield