An Equitable Life-Line? What an Improving Rental Market Means to Scottsdale Real Estate Combatants

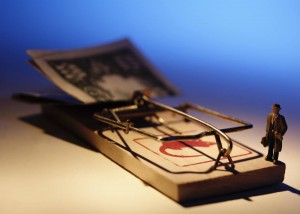

Among the interesting turnabouts that abound in the Scottsdale Real Estate market as of late, the rental market has demonstrated surprising new strength. Where there was formerly a preponderance of housing options for prospective tenants over the last couple of years, what with all the struggling homeowners out there eager to find someone else to pay their mortgage while they shacked up in less costly digs, a noticeable contraction in available properties for lease is occurring. With more and more people walking away from their upside down homes, whether by necessity or by choice, the credit and financial hits they take in the process renders them radioactive to the purchasing option for years to come (though, some have perfected the “buy and bail” strategy of purchasing a new home before abandoning the current residence). As such, the rental market has become inundated with demand.

With this surge in demand and a subsequent decrease in supply, rental values have not only held firm, but have noticeably increased in the markets I work. From a purely anecdotal standpoint, I have been shocked by the level of competition for not only the properties I have had listed for lease recently, but for the tenants I have worked with to secure rental properties as well. Mind you, I am not simply referring to the low end pricing (sub $1000/month) where heightened competition is always to be expected, but in more expensive price ranges to boot. In particular, I am seeing a LOT of interest in properties that are renting in the $1400-1800 per month range.

Checking the latest statistics to see if what I have noticed is playing out on a larger scale, I see active Scottsdale rental listings are down to roughly 1800 units (as of ARMLS’s May figures). This marks a steady decline from an inventory that reached a high point of 2568 in November of 2008 and did not dip under the 2000 unit threshold until January 2010. The 5.19 months of rental housing supply (as determined by the current rate of absorption) is at its lowest point in years. Interestingly, the overall average rental rate has not shown a noticeable jump, despite my recent personal observations. Given the decrease in total inventory and increase in absorption (units leasing per month), however, I fully anticipate next month’s numbers to reflect a higher baseline average.

This shift in the rental market tells me two things:

1) Before deciding to walk away from a house that appears irretrievably underwater in terms of negative equity, homeowners (and potential future renters) really need to study their options carefully. If I had a nickel for every misguided homeowner who erroneously believed there was an unmitigated plethora of housing options, at bargain basement prices, waiting for them once they pulled the plug on the Bank of Extortion … er, I mean “America” … I could comfortably retire to my literary tinkerings. The assumption that lower selling prices go arm in arm with lower rental rates is patently false. Further, with all of the newfound competition for rental housing, your chewed up credit report will be scrutinized a bit more by potential landlords than most would expect. Sure, a human landlord may be more understanding of the recent economic woes than some faceless underwriter, but as in any free market, it always comes back to options. If there are renters out there with fewer credit issues and deeper pockets, you are going to get aced out. Please consider where your escape pod is heading before abandoning ship and scuttling that home turned financial Death Star. If there is no soft landing, how have you benefitted?

2. Our market may have reached (or is close to reaching) that sweet spot in which it makes sense for the homeowner with designs on a move-up purchase to revisit the rental potential of his/her existing home. While the notion of renting an existing house out (to offset the mortgage) to free oneself up to take advantage of the market conditions and purchase a considerably larger home for a fraction of its prior value is nothing new, the increasing strength in the rental market makes the strategy more feasible at present. The biggest hurdle to this play, other than deciding whether one is really cut out to become a landlord, remains the qualification process. Unless you are one of the fortunate few who maintain at least 25% equity in your home, you will essentially have to qualify to carry both loans (the existing house as well as the new one you would purchase). Even if you secure a tenant whose rent will cover the payment, you will be qualified for the new loan as if you were qualifying for both properties. If you have the means to do so, the time could be right to finally leverage the conditions that seemingly everybody and their brother’s mail carrier have already managed to exploit.

Whatever your goals for the Scottsdale Real Estate market, drop us an email or give us a call with your specific needs / questions. You might not be as trapped as you think.

(480) 220-2337 | paul@scottsdalepropertyshop.com