by Paul Slaybaugh | May 13, 2010 | Home Buying, Scottsdale Real Estate

The closing table is no place for incompetence. The crescendo to a Real Estate transaction, the signing of loan documents and the final settlement statement is representative of a successful navigation of the escrow obstacle course. If it were a cinematic experience, an empowering musical score would soar over the montage of conquered struggles that it took to get to this point. While a few credits have to roll before the buyer can officially call the property home, namely lender funding of the loan and recordation of the deed, smiles and handshakes accompany the last executed signature in the two inch stack of paperwork, nonetheless. In years past, agents and consumers alike have been spoiled by the well-oiled machine that was the title and escrow field. Catastrophes arose, catastrophes abated and we lost our minds if a closing was delayed twenty four hours by unavoidable eventualities.

These days, I consider myself lucky if a closing isn’t delayed two weeks and my clients draw anyone other than Sparky, the one brain-celled signing agent.

With new disclosure regulations, a completely different settlement statement and a host of new concerns with the transfer of clear title due to the pervasiveness of foreclosure and short sale properties in our midst, an accomplished escrow officer has never been more vital to the process of a home sale. Unfortunately, many of the good ones were forced out of the industry when the market hit the skids in 2007. When sales finally began to rebound, the major title/escrow companies restocked their ghost offices. As the predominance of these properties were distressed, however, it was the REO (bank foreclosures) and short sale divisions that welcomed new staff. The resale divisions remain largely undermanned.

The REO division of a title company is an entirely different universe. Like that of a REALTOR who specializes in listing bank property, transactional volume is ludicrously high. Too many files on too few desks. You can imagine how this translates to the urgency with which your file gets treated. Another component that is not necessarily to the buyer’s benefit is the relationship between the bank and the title company they have procured. Supposedly a neutral third party whose purpose is to convey the property from the current owner to the buyer, the myth of its transactional Switzerland is a tale taller than the Alps. If the sheer dollars involved in a title company’s relationship with a bank (or the bank’s asset management affiliate) does not dictate outright obedience to the demands/whims of one party over the other, it sure does influence behavior. I have been nonplussed during the course of bank property transactions (the buyer MUST use the bank-selected title company if his/her offer is to be accepted) in which the title company is the one contacting me with seller demands, essentially performing the role of the listing agent by proxy.

It is expected that one will have to tolerate a third party that is subservient to its master in a bank property sale (and not overly concerned with getting the file closed in a timely fashion to boot), but problems are now creeping into “normal” resale transactions between living, breathing human buyers and sellers. For starters, with many resale divisions depleted of adequate staff, it is not an unlikely scenario to get stuck with an escrow officer who primarily handles REO accounts. Flip a coin between whether said officer is overworked or under-experienced, but too often lately a less than exemplary job is being done. Documents are not being requested/delivered on time, assistants are left to answer questions they are not ready to field, communication between the officer and the buyer’s lender is nonexistent … I’ve even encountered “signing agents” at closing who are neither the selected escrow officer, nor capable of explaining the documents upon which they want your signatures. One clown literally tossed the paperwork in my lap and told me to explain it all to my clients. Had I not been rendered utterly speechless, I would have ordered the hall monitor to escort the fresh lad to detention.

Mind you, these are not mom & pop style title companies, but reputable names that do a very high volume (perhaps too high?) of business.

The moral of the story? Unless you are purchasing a bank property, and thereby resigned to the amusement of escrow fate, you have a choice in the matter. As the buyer, you get first crack at naming the title company in your initial offer. Sellers (upon direction from their chosen representatives most often) may list their own preferred company amongst the terms that are countered, but don’t cave. Unless your agent can point to specific, positive dealings with said officer/company in the past, I urge you to stick to your guns. Going back four or five years, a title company was largely a disposable part of the negotiation. As long as you got your price, you let the other party get the perceived “win” of naming the company. The recent changes to the escrow landscape make such a laissez faire approach to the title work fraught with peril. Make this term non-negotiable. More often than not, the other party will buckle rather than lose a sale over what many still consider a minor point.

When selecting a company, your chosen agent is the best source of advice. We have favorites for a reason, and it is not monetary. Through trial and error, we find excellence in all of our affiliates. When we find a diligent service provider, we are loyal. In this day and age, though, a little prevent defense is still warranted. Ask your agent who underwrites the title policies of his recommended escrow company (title and escrow are not necessarily synonymous) before satisfying yourself as to its viability.

I happen to use Jenny Werner with First Arizona Title. Her policies are underwritten by the big boys at First American. She chaperones her files quite adeptly to prevent avoidable delays and miscues, and is very responsive to consumer questions/concerns. Whether you employ me to assist you in the purchase of a home or not, I highly recommend you write Jenny’s services into the agreement. Your movers and peace of mind will thank you for it. Eventually, the other party will as well.

________________________________

Jenny Werner, First Arizona Title

11333 N. Scottsdale Road

Suite 160

Scottsdale, AZ 85254

Phone: (480) 385-6500

Fax: (480) 385-6800

________________________________

by Paul Slaybaugh | May 12, 2010 | Scottsdale Real Estate, This & That

Ninety two contentious minutes into a 90 minute contest, the pitch is littered with casualties. Spent forwards, midfielders and fullbacks slogging wearily through stoppage time. Lungs seared from fruitless forays into the opposing half of the field, calves and hamstrings cramping from dehydration, members of both squads looking to the official for mercy.

Stop the game already, their eyes plead. In their weakened states, they are satisfied with a draw. Nil-nil. No glory, but no shame either. Just end this madness and take away the pain.

Not me. I play this game to win. Always. Fighting through elbows and spikes-up challenges all afternoon, I await my chance. That one bounce of the ball that will loose me. A coiled spring, all I need is one step and I’m gone. The jamoke trying to defend me does not have a prayer. Just let the ball squirt free along this right sideline. Just once.

And then it happens.

A poor touch by the center midfielder and the shining sphere of possibility bounces my way. Twenty yards in front of me with no defender in sight, the ball urges speed into my heavy legs. My shadow senses the moment, too. It’s a footrace.

Not feeling the handful of jersey being tugged from behind, ignoring the attempts to ensnare my feet, I rocket past my rival. He might as well be dipped in lead and cast in stone. Are my feet even touching the ground?

By the time I reach my quarry, I’ve built a full head of steam. The sweeper is running headlong towards me, but his is a fool’s errand. Lothar Matteus himself stands no chance at this very moment. A quick juke to the left followed by a step-over to the right, and his legs are agape. A deft touch of the ball through his wickets and I blow past his shoulder to recollect what is mine.

I see the referee out of the corner of my eye, surprised into action. He’s glancing at his watch, but he knows there will be resolution before putting lips to whistle. The linesman is galloping up his sideline in vain attempt to follow the action. Forget it, old boy. You will be a distant spectator to this penultimate play.

It’s just me and the keeper.

Having utterly stonewalled my mates thus far, my foe is formidable. Six foot four and full of muscles.

I choose my angle of attack and approach at 3/4 speed. All the while, competing voices in my head are shouting instructions:

“Deke it past him low and hard! ”

“Wait for him to go into his slide, then lift the ball over him!”

“Blow right past him and dribble the ball into the net!”

“Blast it into the upper 90!”

I ignore them all. I have been here before, and my body knows what to do. Years of practice guide me through the next three seconds. The crowd disappears. The field becomes the neighborhood park where I spent the weekends of my youth. I see the orange cones staggered over the next ten yards and navigate them flawlessly. Drawing my right leg back powerfully, I don’t even look at the hard-charging goalie.

BOOM.

All of my remaining energy and force are transferred into the ball. I know I’ve caught it well because I don’t feel a thing as I strike through it. Utterly drained and yielding to momentum, I fall forward with the shot. I hear the shrill hiss as the ball charts a path to destiny. Lifting my face from the ground to track its flight, I see it just nick the goalkeper’s outstretched fingertip. Enough to alter its path? Hard to say.

And so I watch. And I wait.

by Paul Slaybaugh | May 11, 2010 | Scottsdale Real Estate

It will come as no ground-shaking revelation that I want your business when you buy or sell a home in Scottsdale, Paradise Valley or the greater Phoenix area. It’s what I do, and I solicit that business, sometimes subtly, sometimes beat-you-over-the-head-with-my-resume overtly, within the confines of this blog on a daily basis. While there is little mystery in the primary services I offer to local consumers (“buyer’s agent,” “listing agent” and “headache sherpa” are all acceptable guesses), there is another aspect to this diligent Realtor’s usefulness that is sometimes overlooked: the quality referral.

Sure, consumers think to seek the names of local contractors and professionals from their respective agents, but what of the out of area service providers? Whether the client is relocating or seeking assistance for a friend or family member in another location, they often take to the internet or phone book to find assistance. Little do many know that the very best resource for an out of area referral is none other than their own local agent.

In years past, we agents were often very brand loyal in the placement of our referrals. Whether due to a conscious effort to keep things “in-house,” a matter of convenience, or a case of hoping the same corporate shingle would translate to a similar work ethic/methodology, we were limited by available resources. These days, however, the explosion of Real Estate driven websites, blogging platforms and social media has helped connect forward-thinking agents in unprecedented fashion. Through said arenas, we are able to far surpass the dark age reliance on blind selection from an incomplete list or static resume. In the vibrant, transparent Web 2.0 world, true professionalism and terrifying idiocy are both quick to reveal themselves. Through years of interaction with agents across these forums, I have cobbled together a relocation team by happenstance. No longer do I have to cross my fingers when making a referral to another agent, as I have trusted professionals in countless nooks and crannies throughout the country.

Going back to Cali and need an agent to help you discover Topanga Canyon? I’ve got you covered.

Topanga a little spendy for your budget? Perhaps this Ventura County Realtor can find something more your speed.

Is the Pacific Northwest calling your name (or tapping it out via Morse raindrop code, as it were)? You will be in good hands with the best Salem, Oregon Real Estate agent (and part-time Paul tormentor) that I know.

From the stockyards of Fort Worth, Texas to the West Bank of New Orleans, my network is comprised of not only outstanding agents, but truly exceptional people.

Do your folks back East want to join you here in Scottsdale? I don’t blame them. Make sure they speak to this Colts Neck, New Jersey Real Estate agent. Whatever he tells them about me is a lie.

And your cousin needs an agent in Pennsylvania? Tell this West Chester, PA Realtor that Dimples says hello.

Tired of the rat race of the lower 48 and eager to get your Jack London on? Give my best to the Spouses Selling Houses in Fairbanks, Alaska when they find you the ideal wilderness retreat.

The online Real Estate community continues to prove a boon for consumers and agents alike. While information is readily available for most any need, information alone cannot supplant the first-hand experience gained through established relationships. Take advantage of the unexpected connections your chosen representative has forged during the growth of his/her online presence. If I don’t personally know an agent in a particular market, you can rest assured that a member of my relocation network will. Six degrees of Real Estate separation? Hardly. At most, I’ll require two.

Oh, and I also know to whom I wouldn’t send a client for all the consonants in Poland. Consult your Realtor if for no other purpose than to ensure that no Gorgons make an appearance on the short list of candidates.

My reputation is on the line when I trust another agent with my clients’ business. It is a responsibility I take seriously. No matter where your Real Estate need arises, contact me before going it alone. Chances are I am exactly one phone call away from ensuring that you or your loved one enjoy the Real Estate experience you deserve. It’s the next best thing to packing up your agent and taking him with you.

Of course, if you are moving to Bora Bora, I’m willing to commute.

by Paul Slaybaugh | May 10, 2010 | Scottsdale Real Estate, This & That

Real Estate Investor.

The phrase alone inspires a host of reactions that run the full gamut between antipathy and, well, slightly lesser antipathy, depending on the audience.

As any semi-interested news watcher and industry blog reader can attest, the Real Estate investor is the greatest scourge to befall our fragile ecosystem since polybutylene plumbing. What, with the housing supply lines ill-equipped to handle the artificial demand, our flimsy pipes swell and burst when the pump and dump investment surge strikes a hapless market. Aside from the banks who flooded Wall Street with dubious mortgage backed securities that were chopped and reconstituted in more numerous and indiscernible ways than Joan Rivers’ alleged face, the fount of no-money-down investors is the most vocally derided catalyst of the Great Real Estate Bubble of 2005 ©.

Well, guess what? The investor is back … and that’s a good thing.

Hold your rotten tomatoes and easy with the pitchforks, if you will. How can I possibly opine that the reemergence of the buyer subset that sent values through the roof, only to crash them through the basement when they left a valley of foreclosed “investments” in their wake is a good thing? Is the demand any less artificial now than it was when the previous incarnation of ne’er do wells spiked our collective punchbowl?

In a word, yes.

The 2010 investor is not the fly-by-night operator who purchased the nearest home for sale at the conclusion of a four hour seminar on how to get rich in Real Estate investing with no money down. Shoot, who needed money down when you barely needed a pulse and a job to buy a house back then? No, today’s investor, by and large, is showing up at trustee sales and plunking down cash on a barrel. He has the skin in the game that his counterpart of yesteryear did not. He is investing in a very real sense of the word.

The 2010 investor is not the fly-by-night operator who purchased the nearest home for sale at the conclusion of a four hour seminar on how to get rich in Real Estate investing with no money down. Shoot, who needed money down when you barely needed a pulse and a job to buy a house back then? No, today’s investor, by and large, is showing up at trustee sales and plunking down cash on a barrel. He has the skin in the game that his counterpart of yesteryear did not. He is investing in a very real sense of the word.

In addition to securing an interest in the property with his own bankroll (thus making the prospects of simply walking away from a property that doesn’t return as hoped less palatable), the other crucial dynamic at play is the return of sanity to the overall investment arena. When investors were driving Scottsdale and Phoenix property values into the stratosphere back in 2005, there was little regard to the initial purchase price. Our entire market temporarily forgot that you make your money on the purchase. Buy a property right, and the return will be there when it’s time to sell. In the throes of insanity, investors were climbing over themselves and each other to purchase property, any property, for 50k over whatever ludicrous price was being sought by an apoplectic seller. Investors were betting on the come. Pay whatever now, and the joint will be worth 100k more in two months whether a hammer is ever swung in renovation or not. With the year long fervor, they got away with it … for awhile.

Today’s investor is not settling for just any property he can get his hands on, but is showing up at the courthouse and robbing the bank blind. Paying pennies on the dollar and rehabbing a previously dismantled home, his margin is large enough to bring the distressed apple of his eye to market at a price actually supported by recent sales comps.

The coup de grace? Today’s investor fills a need that the banks won’t. He is essentially financing the fix-up costs that many banks have abandoned in self-defense. Against a backdrop of tight lending purse strings, consider the difficulty many people have just in coming up with 3.5% or 20% down payments, let alone remodeling capital. With home equity lines all but vanished from the marketplace, that stripped bank-owned home bargain isn’t all that realistic for the buyer who doesn’t have the available cash to put it back together, regardless of how appealing the price tag. When you could tap a line of credit to finance improvements, it wasn’t that big of a deal to throw in some new carpet, counter tops and appliances after closing. Now, you have few options other than reaching into your own pockets. Thus, there is a sizable buyer pool for a move-in ready home. The well heeled investor who assumes the risk and fills that need is not to be derided.

Take the mom & pop homeowners who are unable to price their homes competitively due to high loan balances, mix with the interminable wait of short sales, fold in the distressed condition of much of the bank-owned inventory and bake at four hundred degrees to create a casserole of supreme frustration for many disenchanted home shoppers. A rehabbed home at an affordable price, if not the outright theft that was envisioned at the outset of their house hunt, begins to look more and more appealing to many buyers after getting an up close look at what the reputed bargains actually look like live and in color. In essence, by purchasing a property from an investor, a buyer has found an end-around to financing renovation costs.

If your last nickel is earmarked for your down payment, and you can purchase a renovated home at a fair market value that you can afford, don’t begrudge the man his margin. While the stereotype of the lecherous vulture remains, we would be remiss not to acknowledge the good he can, and does, bring to a market like ours.

Investors: they’re not just for nuclear Real Estate holocausts anymore.

by Paul Slaybaugh | May 10, 2010 | Scottsdale Neighborhoods

McDowell Mountain Ranch is a North Scottsdale master planned community nestled in the foothills of the McDowell Mountains (inconceivable, I know). Originally developed in the mid ‘90s (with fill-in development continuing for the next decade) with subdivisions from well-known builders including Camelot, Shea, Woodside, Ryland, Del Webb, Edmunds, TW Lewis, etc, the once Northern outpost to Scottsdale has become much more centralized with the subsequent completion of the Loop 101 freeway and ensuing development. Home to some 4000 residences and 26 subdivisions, this model of low impact development has become one of the most sought-after communities in all of Scottsdale and features property styles for virtually every budget. From modest townhouses to gated enclaves of $1,000,000+ single-family homes, the community appeals to full-time and seasonal residents from all walks of life.

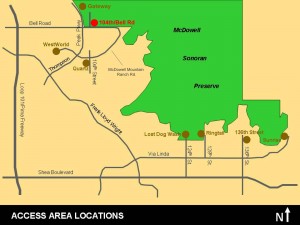

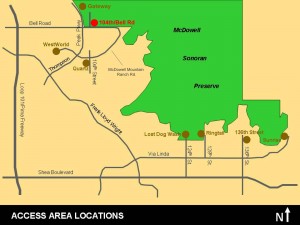

McDowell Sonoran Preserve Access Points (click Image to expand)

In addition to the ample choices of housing (comparatively newer by Scottsdale standards, I might add), McDowell Mountain Ranch has gained its name brand appeal through its amazing confluence of amenities. From the newly completed aquatic center (city park) to the various community pools, parks and centers sprinkled along the community-wide walking path system, there is little that is not offered here. Nature lovers and hiking enthusiasts will lose themselves in the raw beauty of the desert preserves which can be accessed through several trail heads. Boasting city and mountain views, the serendipitous challenge of the Sanctuary Golf Course is enjoyable to serious players and weekend duffers alike. Throw in the Alltel Ice Den (Phoenix Coyotes affiliate ice hockey center), Westworld (equestrian center), restaurants, shopping and conveniences, and McDowell Mountain Ranch is essentially a city unto itself.

As development continues in adjoining communities like Trails North at Horseman’s Park, Windgate Ranch and DC Ranch, this general area is where most Scottsdale home shoppers migrate for newer construction. Developed Northward from her shared border with Tempe, and essentially built-out save for a few isolated pockets, you either have to head North towards Pinnacle Peak (and beyond) or East towards Fountain Hills to find newer homes. Where many home buyers were once forced into the trade-off of an older property for a close-in location, the expansion of the Valley’s infrastructure has made that dilemma a thing of the past. With exit points at both Bell Road and Thompson Peak, McDowell Mountain Ranch enjoys the advantage of having two viable options for freeway access. Once on the 101, you can reach virtually any part of the Valley within 20-30 minutes.

For school information, community attractions and builder floor plans, please see below. Note that the floor plan library, while extensive, is by no means complete. We will be revisiting this post as we add additional builders/models to the list, so feel free to check back on occasion to keep tabs on our progress. Curious what the houses in this community are currently going for? Click on the map at the bottom of the page to view current active listings in McDowell Mountain Ranch.

_____________________________________________________

Schools:

Formerly bussed all the way down to Saguaro High School, McDowell Mountain Ranch high schoolers now attend Desert Mountain High on Via Linda just East of 124th St.

Younger kids don’t have far to travel as both Desert Canyon Elementary and Desert Canyon Middle School are located right in McDowell Mountain Ranch (SE corner of McDowell Mountain Ranch Parkway and Thompson Peak).

In addition to the public schools, the Notre Dame Preparatory High School campus lies just outside of the McDowell Mountain Ranch borders off of Bell Road.

_____________________________________________________

Community Amenities:

Alltel Coyotes Ice Den

McDowell Mountain Ranch Park and Aquatic Center

Westworld of Scottsdale Equestrian Center

McDowell Mountain Ranch Skate Park

McDowell Sonoran Mountain Preserves

Arabian Public Library

Sanctuary Golf Course

_____________________________________________________

Builders | Floor Plans:

Camelot Homes | Vista | Castle Dome | Plan 932| Plan 932-5 | Pinnacle | Mingus | Crest| Summit | Ridge

Cachet Homes |

Centex Homes | Plan 732 | 733 | 734 (1st level) | 734 (2nd Level) | 736 (1st Level) | 736 (2nd Level) |Ladera | Montana | Tierra

Del Webb (Coventry) | Dante | Lido | Medici

Edmunds |

Engle Homes |

Greystone Homes |

KB Homes |

Maracay Homes | Plan 700 | McDowell| Mesquite | Santa Rita | Sierra | Talima

Presley Homes | Aruba | Key Largo | Molokai | Samoa | Victoria

Ryland Homes | Plan 610 | Plan 616 | Plan 622 | Plan 624 | Plan 1744

Shea Homes |

TW Lewis |

UDC Homes |

Woodside Homes | Plan 2 | Plan 2X | Plan 3 | Plan 4 | Plan 4X | Plan 5 | Plan 5X

_____________________________________________________

Latest Homes for Sale in McDowell Mountain Ranch