by Paul Slaybaugh | May 10, 2010 | Scottsdale Real Estate, This & That

Real Estate Investor.

The phrase alone inspires a host of reactions that run the full gamut between antipathy and, well, slightly lesser antipathy, depending on the audience.

As any semi-interested news watcher and industry blog reader can attest, the Real Estate investor is the greatest scourge to befall our fragile ecosystem since polybutylene plumbing. What, with the housing supply lines ill-equipped to handle the artificial demand, our flimsy pipes swell and burst when the pump and dump investment surge strikes a hapless market. Aside from the banks who flooded Wall Street with dubious mortgage backed securities that were chopped and reconstituted in more numerous and indiscernible ways than Joan Rivers’ alleged face, the fount of no-money-down investors is the most vocally derided catalyst of the Great Real Estate Bubble of 2005 ©.

Well, guess what? The investor is back … and that’s a good thing.

Hold your rotten tomatoes and easy with the pitchforks, if you will. How can I possibly opine that the reemergence of the buyer subset that sent values through the roof, only to crash them through the basement when they left a valley of foreclosed “investments” in their wake is a good thing? Is the demand any less artificial now than it was when the previous incarnation of ne’er do wells spiked our collective punchbowl?

In a word, yes.

The 2010 investor is not the fly-by-night operator who purchased the nearest home for sale at the conclusion of a four hour seminar on how to get rich in Real Estate investing with no money down. Shoot, who needed money down when you barely needed a pulse and a job to buy a house back then? No, today’s investor, by and large, is showing up at trustee sales and plunking down cash on a barrel. He has the skin in the game that his counterpart of yesteryear did not. He is investing in a very real sense of the word.

The 2010 investor is not the fly-by-night operator who purchased the nearest home for sale at the conclusion of a four hour seminar on how to get rich in Real Estate investing with no money down. Shoot, who needed money down when you barely needed a pulse and a job to buy a house back then? No, today’s investor, by and large, is showing up at trustee sales and plunking down cash on a barrel. He has the skin in the game that his counterpart of yesteryear did not. He is investing in a very real sense of the word.

In addition to securing an interest in the property with his own bankroll (thus making the prospects of simply walking away from a property that doesn’t return as hoped less palatable), the other crucial dynamic at play is the return of sanity to the overall investment arena. When investors were driving Scottsdale and Phoenix property values into the stratosphere back in 2005, there was little regard to the initial purchase price. Our entire market temporarily forgot that you make your money on the purchase. Buy a property right, and the return will be there when it’s time to sell. In the throes of insanity, investors were climbing over themselves and each other to purchase property, any property, for 50k over whatever ludicrous price was being sought by an apoplectic seller. Investors were betting on the come. Pay whatever now, and the joint will be worth 100k more in two months whether a hammer is ever swung in renovation or not. With the year long fervor, they got away with it … for awhile.

Today’s investor is not settling for just any property he can get his hands on, but is showing up at the courthouse and robbing the bank blind. Paying pennies on the dollar and rehabbing a previously dismantled home, his margin is large enough to bring the distressed apple of his eye to market at a price actually supported by recent sales comps.

The coup de grace? Today’s investor fills a need that the banks won’t. He is essentially financing the fix-up costs that many banks have abandoned in self-defense. Against a backdrop of tight lending purse strings, consider the difficulty many people have just in coming up with 3.5% or 20% down payments, let alone remodeling capital. With home equity lines all but vanished from the marketplace, that stripped bank-owned home bargain isn’t all that realistic for the buyer who doesn’t have the available cash to put it back together, regardless of how appealing the price tag. When you could tap a line of credit to finance improvements, it wasn’t that big of a deal to throw in some new carpet, counter tops and appliances after closing. Now, you have few options other than reaching into your own pockets. Thus, there is a sizable buyer pool for a move-in ready home. The well heeled investor who assumes the risk and fills that need is not to be derided.

Take the mom & pop homeowners who are unable to price their homes competitively due to high loan balances, mix with the interminable wait of short sales, fold in the distressed condition of much of the bank-owned inventory and bake at four hundred degrees to create a casserole of supreme frustration for many disenchanted home shoppers. A rehabbed home at an affordable price, if not the outright theft that was envisioned at the outset of their house hunt, begins to look more and more appealing to many buyers after getting an up close look at what the reputed bargains actually look like live and in color. In essence, by purchasing a property from an investor, a buyer has found an end-around to financing renovation costs.

If your last nickel is earmarked for your down payment, and you can purchase a renovated home at a fair market value that you can afford, don’t begrudge the man his margin. While the stereotype of the lecherous vulture remains, we would be remiss not to acknowledge the good he can, and does, bring to a market like ours.

Investors: they’re not just for nuclear Real Estate holocausts anymore.

by Paul Slaybaugh | May 10, 2010 | Scottsdale Neighborhoods

McDowell Mountain Ranch is a North Scottsdale master planned community nestled in the foothills of the McDowell Mountains (inconceivable, I know). Originally developed in the mid ‘90s (with fill-in development continuing for the next decade) with subdivisions from well-known builders including Camelot, Shea, Woodside, Ryland, Del Webb, Edmunds, TW Lewis, etc, the once Northern outpost to Scottsdale has become much more centralized with the subsequent completion of the Loop 101 freeway and ensuing development. Home to some 4000 residences and 26 subdivisions, this model of low impact development has become one of the most sought-after communities in all of Scottsdale and features property styles for virtually every budget. From modest townhouses to gated enclaves of $1,000,000+ single-family homes, the community appeals to full-time and seasonal residents from all walks of life.

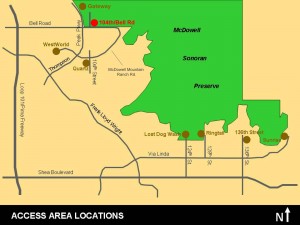

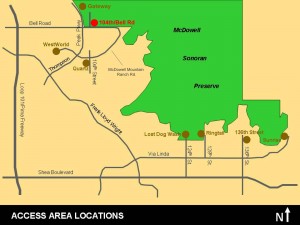

McDowell Sonoran Preserve Access Points (click Image to expand)

In addition to the ample choices of housing (comparatively newer by Scottsdale standards, I might add), McDowell Mountain Ranch has gained its name brand appeal through its amazing confluence of amenities. From the newly completed aquatic center (city park) to the various community pools, parks and centers sprinkled along the community-wide walking path system, there is little that is not offered here. Nature lovers and hiking enthusiasts will lose themselves in the raw beauty of the desert preserves which can be accessed through several trail heads. Boasting city and mountain views, the serendipitous challenge of the Sanctuary Golf Course is enjoyable to serious players and weekend duffers alike. Throw in the Alltel Ice Den (Phoenix Coyotes affiliate ice hockey center), Westworld (equestrian center), restaurants, shopping and conveniences, and McDowell Mountain Ranch is essentially a city unto itself.

As development continues in adjoining communities like Trails North at Horseman’s Park, Windgate Ranch and DC Ranch, this general area is where most Scottsdale home shoppers migrate for newer construction. Developed Northward from her shared border with Tempe, and essentially built-out save for a few isolated pockets, you either have to head North towards Pinnacle Peak (and beyond) or East towards Fountain Hills to find newer homes. Where many home buyers were once forced into the trade-off of an older property for a close-in location, the expansion of the Valley’s infrastructure has made that dilemma a thing of the past. With exit points at both Bell Road and Thompson Peak, McDowell Mountain Ranch enjoys the advantage of having two viable options for freeway access. Once on the 101, you can reach virtually any part of the Valley within 20-30 minutes.

For school information, community attractions and builder floor plans, please see below. Note that the floor plan library, while extensive, is by no means complete. We will be revisiting this post as we add additional builders/models to the list, so feel free to check back on occasion to keep tabs on our progress. Curious what the houses in this community are currently going for? Click on the map at the bottom of the page to view current active listings in McDowell Mountain Ranch.

_____________________________________________________

Schools:

Formerly bussed all the way down to Saguaro High School, McDowell Mountain Ranch high schoolers now attend Desert Mountain High on Via Linda just East of 124th St.

Younger kids don’t have far to travel as both Desert Canyon Elementary and Desert Canyon Middle School are located right in McDowell Mountain Ranch (SE corner of McDowell Mountain Ranch Parkway and Thompson Peak).

In addition to the public schools, the Notre Dame Preparatory High School campus lies just outside of the McDowell Mountain Ranch borders off of Bell Road.

_____________________________________________________

Community Amenities:

Alltel Coyotes Ice Den

McDowell Mountain Ranch Park and Aquatic Center

Westworld of Scottsdale Equestrian Center

McDowell Mountain Ranch Skate Park

McDowell Sonoran Mountain Preserves

Arabian Public Library

Sanctuary Golf Course

_____________________________________________________

Builders | Floor Plans:

Camelot Homes | Vista | Castle Dome | Plan 932| Plan 932-5 | Pinnacle | Mingus | Crest| Summit | Ridge

Cachet Homes |

Centex Homes | Plan 732 | 733 | 734 (1st level) | 734 (2nd Level) | 736 (1st Level) | 736 (2nd Level) |Ladera | Montana | Tierra

Del Webb (Coventry) | Dante | Lido | Medici

Edmunds |

Engle Homes |

Greystone Homes |

KB Homes |

Maracay Homes | Plan 700 | McDowell| Mesquite | Santa Rita | Sierra | Talima

Presley Homes | Aruba | Key Largo | Molokai | Samoa | Victoria

Ryland Homes | Plan 610 | Plan 616 | Plan 622 | Plan 624 | Plan 1744

Shea Homes |

TW Lewis |

UDC Homes |

Woodside Homes | Plan 2 | Plan 2X | Plan 3 | Plan 4 | Plan 4X | Plan 5 | Plan 5X

_____________________________________________________

Latest Homes for Sale in McDowell Mountain Ranch

by Paul Slaybaugh | May 6, 2010 | Home Selling, Scottsdale Real Estate

There is nothing the Real Estate industry loves more than a good cliche. The more hackneyed the slogan, the more likely we are to roll it into our marketing campaigns. Take the expressions which appear on an old industry stalwart, the sign rider, with frightening regularity. Intended to separate a listed house from the herd, many of the verbal gutterballs instead relegate their hapless charges to the back of the pack. You’ve seen the repeat offenders and mocked not only their stunning lack of originality, but more to the point, their inability to inspire … well … anything within your consumptive little heart.

If you will humor the presumption, I’d bet my license that my attendant impressions from the following gambits jive with those of today’s buyer to the tee.

“I’m Beautiful Inside” is henceforth redubbed “Coyote Ugly from the Street,” or “Look Past My Goiter and Love Me For Me.”

“Very Special!” is not outwardly off-putting, but it carries a stunning lack of associative context. While I happen to be very special to my mother, the man on the street just might cut my throat for the eight bucks in my wallet. If one can’t think of anything in particular that is worthwhile about the property, “Very Special” seems to fit the vanilla bill.

The insecure younger sister to the first member of our list, “I’m Gorgeous!” is a tired refrain from a house who doth protest too much. When was the last time that the person who regaled you for hours on end with tales of a jet-setting fashion model’s life was a true American beauty? It just doesn’t happen. Such a lovely has learned that his/her stunning visage requires no hyperbolic self-aggrandizement. This house, on the other hand, is the eight foot sasquatch with bad skin who won’t shut up about herself.

“Terms” – While agents generally know this to mean there may be some kind of owner financing available, this one is just patently confusing to the general public. Of course there are terms. Whether you are selling a home or Pet Rock, all transferences of ownership come with terms. Such as, “You pay X, I give you house.”

“Voted First On Tour!” – Congratulations, you beat out two other houses for the distinct honor. Seriously, if the agent’s colleagues were so taken with the home, where is the procession of buyers? My first reaction to such a proclamation is to surmise that the home has hung around the market long enough to make it into a tour lineup. Must be overpriced.

“Pool” – What else needs to be said? Some might argue that isolating any one feature of the home is pointless without the rest of the details, but I say who cares how many bedrooms, bathrooms, square feet, etc this home has? It has “Pool.”

“Extra Special!” – Oh snap! Take that “Very Special!”

“Pride of Ownership!” – For every abortion of a house out there, there is a proud homeowner. Shoot, that same owner is likely just as proud of his forty year old kid who still lives in the basement. Forgive me if I don’t lean too heavily on the hubris of persons unknown.

“Original Owner” – The decor has remained hermetically sealed within this time capsule since 1958. Forensic anthropologists will break down the door in the year 2200 to study the long-term effects of asbestos on shag carpeting.

“Won’t Last!” – Wanna bet?

“Look Here >>>” – I love this one. I mean, I absolutely love this one. If you somehow managed to notice the evidently insufficient “For Sale” sign, you are prompted to look at it. By a rider whose visibility requires you are already looking at it. A paradoxical delight.

“Neighborhood Specialist” – Silly me. Here I thought the idea was to promote the house.

I ridicule the use of trite slogans on Real Estate sign riders only because I have been there, done that. I am not exempt from this carnival of pie-throwing derision. At some point along my professional arc, I have tried just about every silly rider there is to get the attention of passersby. Through trial and error, I have come to realize the only one that is consistently effective is a website address. Rather than trying to sell a home in one to three words, it’s best to utilize that space to send prospective buyers somewhere they can get all of the property details. Properly designed, said website will catch your fly in a sticky web of additional buyer tools and resources. The idea is to keep them coming back for more, with your home top of mind all the while. Don’t tell a buyer how beautiful you are inside as they pass by, direct them to a resource which shows them in painstaking detail. Don’t distill the core value of the home all the way down to “Pool.” Funnel them to a place where the pool, 4 bedrooms, 3 bathrooms, upgraded kitchen, hardwood floors, new A/C and half acre lot share equal billing. This is how you best leverage a rider to trade up to its penultimate incarnation: “SOLD!”

Or you can continue to try to reel them in with your “Carpet Allowance!”

Your choice.

by Paul Slaybaugh | May 6, 2010 | Home Buying, Scottsdale Real Estate

So you were a good little boy scout and extracted a home warranty policy out of the seller during the negotiations for your recent home purchase. Or perhaps, unable to coax the relatively small potato item out of the seller, you opted to take your agent’s advice and spend the $400-1000 to purchase one yourself. After all, it’s pretty cheap insurance against Murphy’s Law (which holds that no fewer than four items which were inspected and functional as of a two weeks ago will simultaneously explode upon closing). While I always advise my clients to seek the protections of a home warranty, at least for the first year in which they are getting accustomed to the workings of a new home, it would be irresponsible to overlook the shortcomings of such policies. Like any other form of insurance, they are not bullet-proof, all-encompassing panacea’s for the maintenance headaches that will dot a homeowner’s horizon.

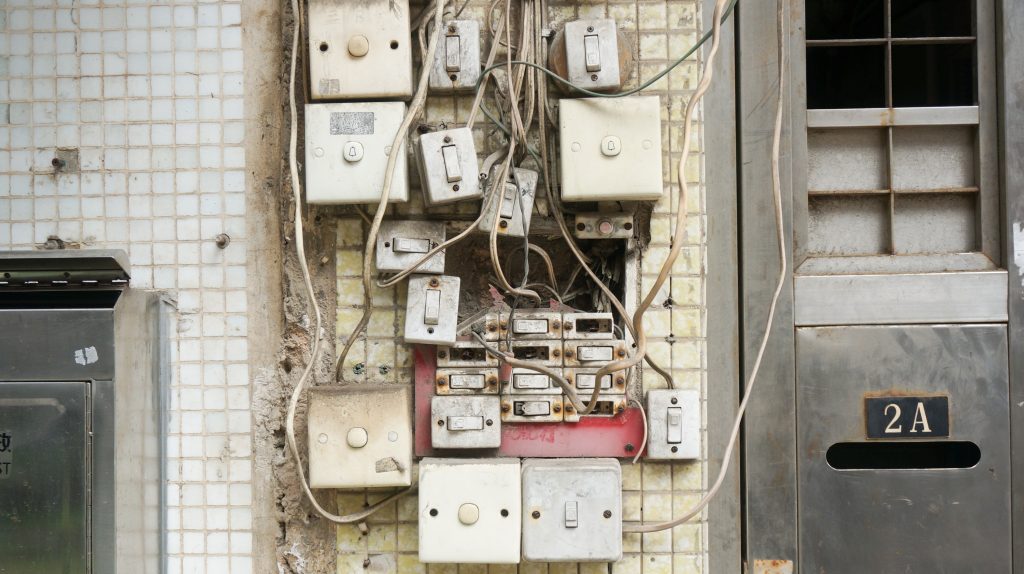

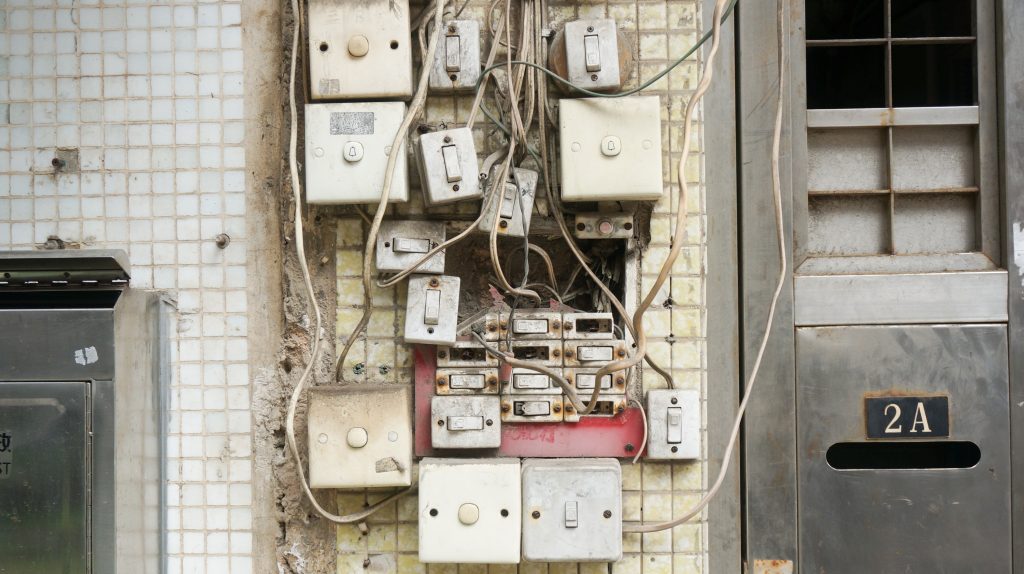

All resale homes come with pre-existing conditions. Whether the shower valve leaks when engaged, or a faulty electrical breaker causes a circuit to trip (without fail during the penultimate moment of your favorite television show), I have yet to encounter the home that does not have its own idiosyncratic, malfunctioning cross to bear. A diligent home inspection should uncover the lion’s share of the problems, but some can and do slip through the cracks on occasion. “No problem,” the common line of thought goes, “I’ll just call my home warranty provider” to correct whatever problem rears its head. The premise itself is not faulty, as home warranties are attractive for their very nature of warding off the unknown, but the assumption that whatever breaks will be covered is patently false.

Like your health insurer, the home warranty company is making the calculated gamble that the cost of your policy will outweigh the cost of the claims/repairs racked up during the coverage period. Safeguards are put in place to minimize the provider’s exposure. For starter’s, whichever company you opt to employ will include verbiage somewhere in their policy that disavows any responsibility for deficiencies in the home which pre-existed the coverage period. In other words, DO NOT assume that you can simply call the home warranty company to make repairs to items on the home inspection report that the seller refused to address during the escrow period. While no representative from the home warranty company will inspect the home prior to closing to determine what is, and what is not an existing condition, you will have a very difficult time getting them to come out to make repairs the day after you close. They will fight that claim tooth and nail as a pre-existing item.

The next difficulty you may encounter with your warrantor is the “amateur installation” clause. This is another area in which you are reliant on the diligence of your home inspector. Should the seller (or any previous owner/contractor for that matter) have jury-rigged any wiring, improperly installed new A/C components or soldered a plumbing joint with all the refined skill of a narcoleptic baboon, the warranty company will deny the claim for any repairs related to such items. If your inspector discerns that the home has played host to amateur contracting hour over the years, either demand professional repairs be made by a licensed contractor prior to the close of escrow, or expect to finance those repairs out of your own pocket. You warranty provider most assuredly will not.

Lastly, the biggest difficulty that most new homeowners run into with their home warranty lies within the fine print of the specific coverages provided. Oddly enough, most people never think to actually read the policy until after the transaction has closed and something in the house blows up. Treated as an afterthought in which the buyer’s agent often suggests a reputable company while sitting around the closing table, the soon-to-be homeowner is never fully briefed on what gets fixed and what is beyond the scope of the policy. Depending on the options (offered at additional expense to the basic package) selected, many items that are assumed to be included actually are not. The major working components of the home are covered in all standard policies, but there is minutia with which to concern yourself. For example, while interior plumbing pipes are covered, showerheads and faucets may not be. Exterior water lines (sprinkler systems) and shut-off valves are often excluded from basic policies. The heating element in your built-in microwave should be claim fodder, but maybe not the lighting element. The garage door operator is typically included, but not the door or the mounting track.

Your home warranty will not cover a roof leak unless you have a Cadillac policy.

Other things to note with your policy:

- There will be a service charge every time the warranty company sends out a contractor, typically in the $50-60 range. If the item that needs repair is determined to fall within the scope of your policy, the warrantor will pay for all repair costs above and beyond that service fee.

- You may have to wrestle with the provider on major repair items. If your A/C goes out, you may have to deal with several band-aid type fixes before your warranty provider accepts the eventuality that the compressor needs to be replaced. Not a lot of fun when it is July and a hundred and ridiculous out, but an unavoidable part of the process in some instances.

- Call your REALTOR if the service department stonewalls a legitimate repair claim! We do not wield magic wands (not during business hours, at least), but we do have access to the proper ears to bend in such instances. While the service department is looking for a reason to offset expense and deny claims, we can go straight to the marketing department that solicits our referral business. The same rep who sends us promotional materials, attends our office meetings and leaves the occasional chocolate chip pecan cookie in our inboxes has a far greater incentive to keep us happy than the service department does for a single unhappy customer. I have gotten more than a few denials reversed by shaking this branch of the company tree.

A home warranty is a great and necessary thing, just be aware of its limitations. It is not wholesale insurance against any eventuality with the physical condition of your home. Read the actual coverages of prospective warranty companies before you purchase one. Employ a reputable home inspector to uncover all pre-existing or amateurish conditions to the extent that is professionally possible. Do not accept the sellers inevitable argument against your repair demands that the home warranty policy he/she is buying you will correct all items. Prepare to do battle with your chosen warrantor on high-cost items by familiarizing yourself with the scope of the coverage, enlisting the assistance of your REALTOR and sheer persistence.

As with anything, the protection of a home warranty is only as valuable as your understanding of it.

___________________________________________________

Follow the links below for coverages and options from three large home warranty providers in Scottsdale and the greater Phoenix area.

Old Republic Home Warranty

First American Homebuyers Protection

American Home Shield

The 2010 investor is not the fly-by-night operator who purchased the nearest home for sale at the conclusion of a four hour seminar on how to get rich in Real Estate investing with no money down. Shoot, who needed money down when you barely needed a pulse and a job to buy a house back then? No, today’s investor, by and large, is showing up at trustee sales and plunking down cash on a barrel. He has the skin in the game that his counterpart of yesteryear did not. He is investing in a very real sense of the word.

The 2010 investor is not the fly-by-night operator who purchased the nearest home for sale at the conclusion of a four hour seminar on how to get rich in Real Estate investing with no money down. Shoot, who needed money down when you barely needed a pulse and a job to buy a house back then? No, today’s investor, by and large, is showing up at trustee sales and plunking down cash on a barrel. He has the skin in the game that his counterpart of yesteryear did not. He is investing in a very real sense of the word.